By Alan Gross

“9 in 10 retirees rely on Social Security as a source of income in retirement.”1

None of us should be shocked reading this. While Social Security is an important safety net, it was never designed to fully fund retirement. Our “three-legged stool” metaphor has long represented the idea of Social Security being one source of retirement income alongside pension and personal savings.

The bigger challenge is the number of American workers who are not on track to save enough to fund the monthly living expenses they’ll likely face in retirement. And many (perhaps, most) don’t actually know how much money they’ll need to save to adequately fund their retirement. That makes decisions about how much to save and at what desired rate of return very fuzzy.

“They want it. You have it.” is our new series of posts that speak directly to challenges like this and shares actionable steps you can take as a professional partner to positively affect outcomes.

In Case You Missed It:

Part 1: “6 in 10 people say that preparing for retirement makes them feel stressed,1” read it here.

Part 2: “27% of workers are very confident they will have enough for a comfortable retirement,1” read it here.

After all, if you don’t know how much you’ll need in the future, how can you know if you’re saving enough now?

iJoin helps users understand and optimize the impact of Social Security income in 3 ways:

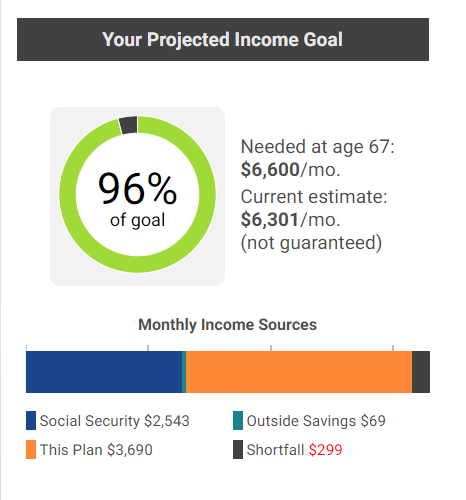

iJoin shows every user a projection of their monthly income in retirement based on the amounts likely to come from Social Security, retirement plan savings, and outside savings.

iJoin instantly updates a user’s projected goal completion based on changes they make (or model) to contribution rates, retirement age, monthly income need, or by adding the value of outside assets.

iJoin’s Social Security Optimizer helps users get the most out of this earned benefit.

Make this actionable:

- Incorporate these iJoin themes into your outreach.

- Demo these features to industry partners and clients.

- Take advantage of the iJoin Partner Marketing videos and collateral.

Reach out to learn more about how to put the power of iJoin to work for you.

Alan Gross is president of GSM Marketing, a marketing partner to iJoin and other leading organizations aligned to the shared goal of producing better retirement plan outcomes.

1 Source: EBRI – 2020 Retirement Confidence Survey Summary Report