By Alan Gross

A popular business development strategy among 401k advisors is to mine Form 5500 data to target plans that may be underserved. The argument that you can provide better service, help create better outcomes, help get a plan on track (or keep it on track), and importantly, help reduce fees are all important drivers in improving the health of the ecosystem.

After all, every plan that runs better and more cost-efficiently is more likely to produce better outcomes for its participants. That said, this has the potential to be an ever-reducing strategy as year over year more plans improve leaving fewer outliers to compete for and win as takeovers.

From a system or industry perspective, this takeover activity should improve the overall performance of existing plans, but it’s a zero-sum game in terms of coverage. And coverage is the real problem. Today, public officials, academics, and others regard the U.S. private sector retirement system with more than a bit of cynicism when they refer to it as a “glass half-empty.” (Let’s face it, the U.S. private sector retirement industry suffers from a branding problem, a messaging problem, a marketing, and a distribution problem.) And this glass is a particularly large one. It’s a measure of the number of people who have the opportunity to participate in a workplace savings plan and the percentage of them who are on track to save enough to fund a comfortable retirement. As an industry, we’ve given them plenty of ammunition. Retirement plans have, for decades, been somewhat complicated, expensive ideas to operate and that has limited its appeal to the broadest possible market.

It explains why nearly all large companies (with 100 or more employees) have retirement plans in place for their workers and why this skews negatively as we look at smaller companies.

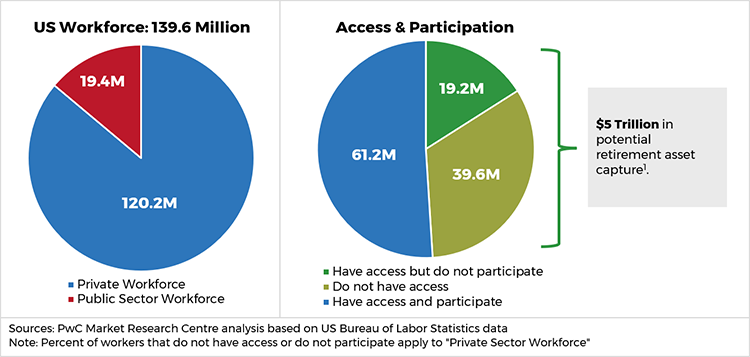

Consider this fact: More than 61 million people currently take advantage of a workplace retirement plan1. The coverage problem – or opportunity, should you wish to see it, is that a number almost as large, about 55 million, don’t have access or are not participating. This is the blue ocean and it’s anything but a zero-sum game. It’s all about expanding retirement savings to millions more people and creating more long-term pathways to retirement income sufficiency. PwC did an analysis of Department of Labor statistics and observed that this market has an asset capture potential of $5 trillion1. Not only does this represent the next great wave of opportunity (pun intended), but it has the greatest potential to guide the industry to achieve its fuller mission.

The winners in this effort will be those who understand the primary requirement to deliver a personalized, easy experience at scale along with super-efficient cost arrangements that remove the barrier of entry for start-up and small plans. And if you’re looking to size this market opportunity, you need only consider there are about 600,000 401k plans today and about 32.5 million “small businesses that represent almost 47% of the U.S. private workforce2.” It’s time to act.

Reach out to learn more about how to put the power of iJoin to work for you.

Alan Gross is president of GSM Marketing, a marketing partner to iJoin and other leading organizations aligned to the shared goal of producing better retirement plan outcomes.

Sources:

1 PWC Market Research Center analysis based on US Department of Labor Statistics

2 Advocacy Releases 2021 Small Business Profiles For The States