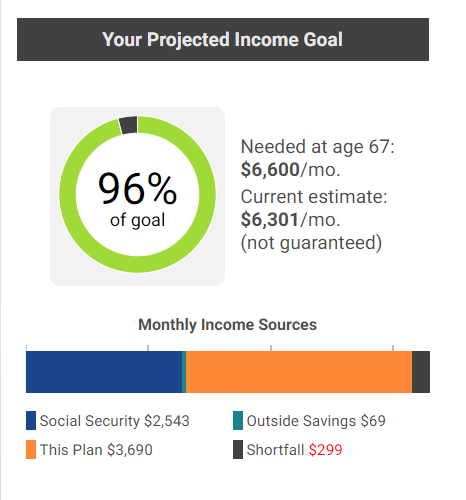

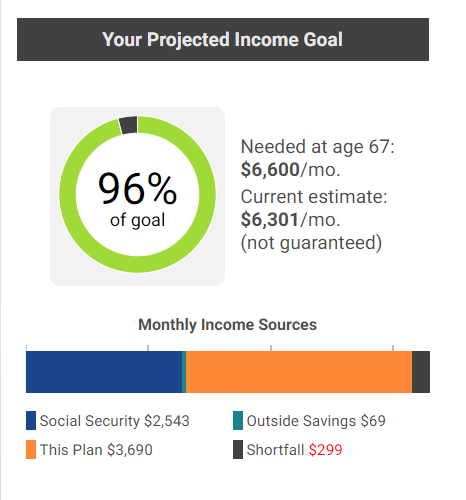

“9 in 10 retirees rely on Social Security as a source of income in retirement.”

None of us should be shocked reading this. While Social Security is an important safety net, it was never designed to fully fund retirement.

“9 in 10 retirees rely on Social Security as a source of income in retirement.”

None of us should be shocked reading this. While Social Security is an important safety net, it was never designed to fully fund retirement.

You see the statistics – the gap in confidence, comfort, or readiness so many people experience when saving for retirement.

Industry surveys of participant engagement and retirement readiness continue to report on familiar themes. It’s no surprise, really,

“Decumulation: The Final Frontier” was a very interesting discussion during November’s SPARK Annual Conference. The session was moderated by Philip...

By Alan Gross Since the beginning of 2011, about 10,000 baby boomers joined the ranks of the retired every single day1. For some, this is a truly...

By Alan Gross Peter Drucker wrote, “Efficiency is doing things well. Effectiveness is doing the right things.” For many years our industry has...

By Alan Gross Retirement plans typically use the single data point of “date of hire” to start someone on their savings path. Auto enrollment...

By Alan Gross If retirement plan success is accumulating enough money to fund retirement, then you could say the single most important step in the...

By Alan Gross One of the most powerful words in marketing technology solutions is “robust.” And robust is often followed closely by scalable,...

By Alan Gross George Harrison sang, “If you don’t know where you’re going, any road will take you there.” The idea for this refrain is attributed...