We’re Changing How the World Looks at Managed Account Programs

iJoin MAP

Managed Account programs serve an important audience: hard working people who don’t have the time or knowledge to confidently select and manage their investments.

As a qualified default investment alternative (QDIA) in retirement plans, a professionally managed account program offers a “do it for me” option for long-term investing. And for many people, this can be a great choice.

In retirement plans, many QDIAs rely on target date funds that, while diversified, are oriented to balance risk and return based on the single data point of a person’s desired retirement age. While they can be productive, they are not designed to optimize each individual saver’s path based on their unique need.

iJoin MAP addresses two critical shortcomings of many QDIA offerings:

1

They fail to address the core question of how much to save.

How much to save is the most important question people have and it’s precisely where we start.

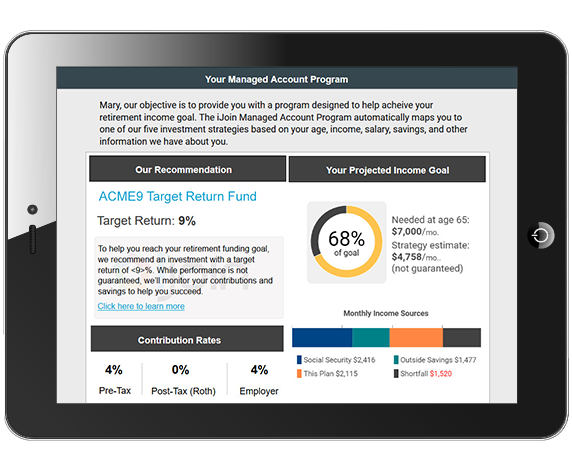

iJoin MAP produces a personalized retirement funding goal for every person based on their age, savings, income and dozens of additional data points. That aligns an investment recommendation to fund their goal. And we report periodically on how well they’re doing towards their goal and suggest ways to close the gap.

2

They don’t project or attempt to fund the saver’s estimated retirement need.

iJoin MAP is a goal-oriented managed account program. It’s a true differentiator.

Our calculation engine automatically draws on dozens of individual data points to determine the retirement goal or funding need. Then, we leverage Liability Driven Investment (LDI) principles to align investments to meet that need. LDI methodology has been used for decades to determine adequate funding of defined benefit plans. We’re making it available to individual plan participants in an automated, yet personalized way.

iJoin answers the most important questions savers face

iJoin replaces retirement calculators with easy to understand information that users can immediately act on to update their preferences and opportunity success.

Without the need for additional retirement calculators, iJoin answers these questions as part of every enrollment:

“How much money will I need to save for retirement?”

“Am I saving enough?”

“How much do I need to contribute?”

“What if I work longer or contribute more?”

LDIndex3

LDIndex4

LDIndex5

LDIndex7

LDIndex9

iJoin MAP Investment Options

iJoin analysis of each participant’s retirement funding need maps to a recommended target-return portfolio. We support an LDIndex lineup of target return products as well as independently managed custom target-return line-up by RIAs.

The LDIntelligence LDIndex lineup is available via models or CITs and may be appropriate for professionals who wish to offer a managed account program, but who do not wish to take on the liability and effort of the ERISA 3(38) investment manager role.

Inquire about custom target-return portfolios.